What work-related car expenses can employees claim?

Car expense claims are one of the most popular deductions claimed each year, but be aware of the rules! Generally, you can’t deduct travel costs between home and work, but you can claim for car travel between two different workplaces and also if you need to drive your own car as part of your job. […]

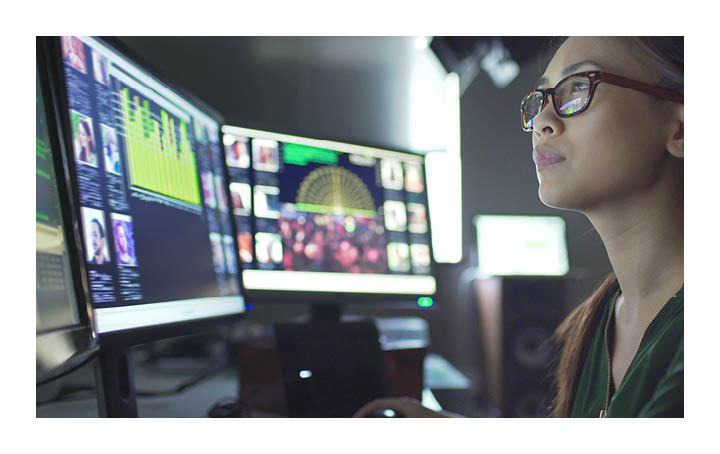

Are you declaring your “odd jobs” income from gig economy sites?

“Gig economy” platforms like Airtasker are allowing Australians to earn some extra cash by completing a huge range of odd jobs – from gardening to data entry and even standing in line for concert tickets! But you must declare the gross income from these “gig economy” platforms in your tax return and keep records of […]

Can my business claim the R&D incentive for software projects?

Is your company planning to develop software as part of an experimental R&D project? You may qualify for the R&D tax incentive, even if you’re not a software developer but operate in a technology-focused industry such as manufacturing. However, the activities you claim for must genuinely meet the relevant tests – and the ATO says […]

ATO benchmarks – a handy business check-up

The ATO’s business benchmark data is a useful tool for smart business owners. Learn how you can access these benchmarks to judge your business’ performance against industry standards, identify your ATO audit risk and other tax compliance issues, and prompt new thinking about ways to improve your profit margins. This data is available for over […]

Three common CGT obstacles for homeowners

Many homeowners are not aware that the “main residence” rules exempting the family home from capital gains tax (CGT) are in fact quite complex and contain many traps. Here we highlight three common scenarios in which a homeowner may face some CGT liability when it is time to sell. 1.Using your home to generate income: If […]

Federal Budget 2019 Spotlight

The 2019 Budget was handed down on Tuesday 2 April by Treasurer Josh Frydenberg a matter of days before Prime Minister Scott Morrison is due to call the next federal election. Thanks to revenue from the lucky rise in commodity prices (coal and iron ore) – and without raising taxes – the Government has undertaken […]

Are you declaring personal use of business trading stock?

Have you ever taken home an item of your business’ trading stock for your own personal use, or use by your family members? This is common in many businesses such as bakeries, butchers and cafés, but it does have some tax consequences. “Trading stock” means anything that you hold in the business for the purposes […]

Working-from-home deductions for employees

If you are an employee and you sometimes work from home, you may be able to claim deductions for some of the expenses you incur, provided you are not reimbursed by your employer. Here, we consider two common types of expenses that employees may claim and how you must substantiate your deductions. Running expenses such […]

What expenses can I deduct for my holiday home

Renting out your holiday home for part of the year can help to finance the costs associated with purchasing and maintaining the property. As well as providing an income stream, this will also allow you to deduct some of the expenses such as interest payments on a loan you have taken out to buy the […]

How does listing my home on Airbnb affect my tax?

Millions of Australians are now using the “sharing” economy to earn some extra money on the side. Thanks to smartphones and user-friendly apps, people can easily access sharing services like ride sharing, accommodation sharing and pet minding. The government is concerned that some Australians who receive income from sharing platforms may not be paying the […]